Accelerate your Private Brand journey

to win with customers and shareholders

Back to All

Insights

Private brands are accelerating amidst slow grocery market growth

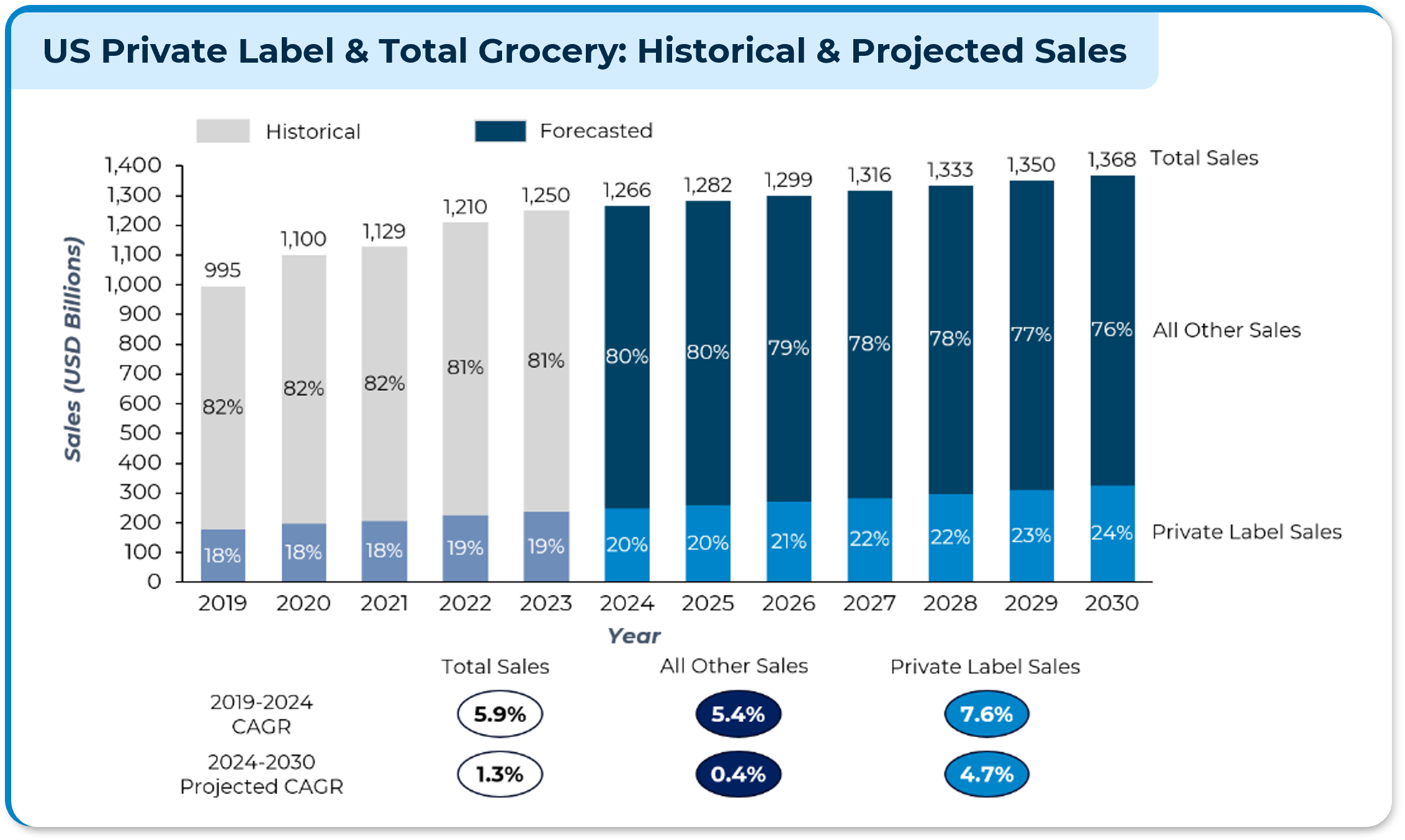

For many grocery shoppers today, the distinction between national brands and private brands is becoming increasingly blurred. Private brands, products manufactured by one company but sold under a retailer’s brand, are continuing to fill more shopping carts than ever before. Private brand penetration rates sit around 20% and are expected to reach 24% by 2030 – still short of comparable European markets, indicating room for continued growth.

After a few years of growth propelled by COVID and inflation, the total grocery market is expected to flatten within the next few years. The projected CAGR over the next 5 years is ~1.3%. However, private brands are projected to grow 4.7% per year in the same timeframe. Grocers that aim to grow at a faster pace than total market will need to gain share on Private Brands. This may allow them to gain share among customers, and at the same achieve shareholders’ expectations of driving incremental growth and profit.

There has been a significant shift from national brands to private brands, and traditional grocers are falling behind

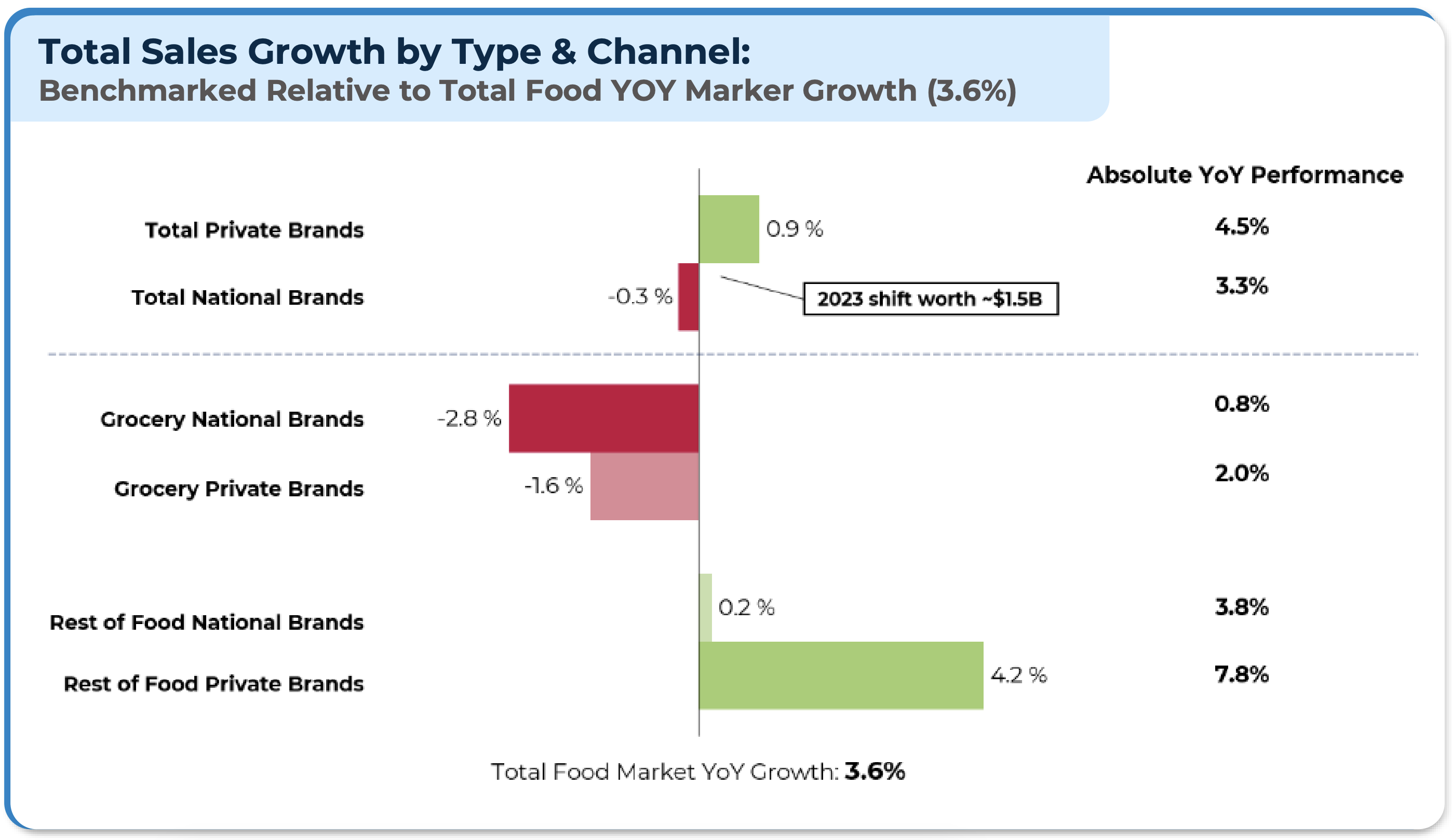

Over the last decade there has been a significant shift in grocery market sales from national brands to private brands. In 2023 alone, the retail value of this shift was ~$1.5B of sales and it is projected to continue and even accelerate in the future.

The majority of the shift from national to private brands has happened across channels: from traditional grocery to “Rest of Food“ (RoF) players such as discount, mass, and club. Private brands grew 7.8% YoY in the RoF channel, and only 2.0% in Grocery.

For traditional grocers, growing a private brand presence does not mean sacrificing existing national brand sales: successful private brand grocers have been able to continue to drive their national branded business while at the same time achieving the performance of other channels in private brands.

By innovating and differentiating their private brands, grocers can regain share of wallet from customers who are making frequent trips to their stores but are purchasing competitor’s private brands in certain categories.

Strong private brand retailers continue to outperform

the market

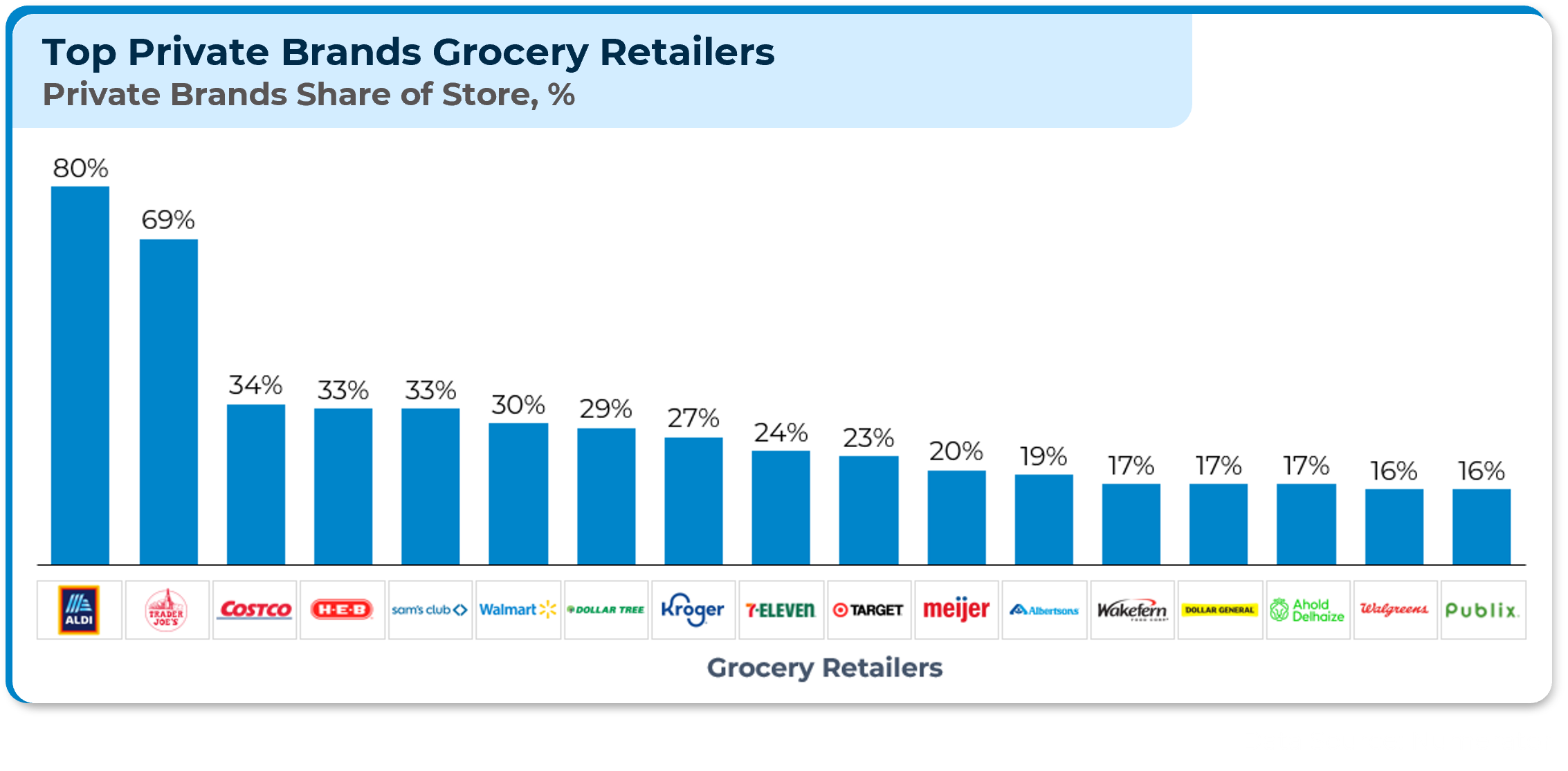

Retailers with the most developed private brand programs continue to win in the marketplace. These companies made private brands a core component of their strategy and have seen their sales, market share, and stock price rise as a result. By adopting private brand products, they have been able to drive differentiation, value, and margins, satisfying both customers and shareholders.

Key Facts

- 7/10 of the top retailers by grocery dollar share are top private brand players

- 144% stock price growth past 5 years for top 4 publicly traded private brand retailers

- > 160 new stores opened in the past year by top private brand retailers

Prominent private brand retailers have built stronger loyalty and advocacy with their shoppers

A defining characteristic of the most successful private brand retailers is that they develop winning brands that customers love. Think Kirkland from Costco, or the Trader Joe’s assortment. These brands are recognizable even amongst a sea of national brands. These brands resonate with consumers: they provide value, being often priced at 30-40% below their National Brands comparable products; they provide differentiation and innovation, featuring unique packaging, flavors, or varieties.

Strong Brand = Strong Performance

The approach market leaders take to Private Brands is fundamentally different

- Chief Merchants who treat Private Brands with the same attention and detail as National Brands

- Year-round commitment to stand behind Private Brands with merch execution (e.g., promotions, space, flyer etc…)

- Marketing and branding efforts which elevate Private Brands, increasing visibility and customer awareness

- Continuous investments to build Private Brand capabilities, such as innovation centers, data-analytics and trend spotting

- Unique or innovative approach to sourcing, including vertical integration, joint ventures and exclusive partnerships

Private Band Considerations

Core imperatives must be answered when developing a Private Brand strategy

1) Brand Architecture

The first key question is whether to pursue storewide or category specific brands. In either case, brands must be curated to foster customer recognition and trust, keeping the potential for future growth and expansion in mind.

2) Organizational Capabilities

Any strategic program requires the correct organization and capabilities to make it stick. Do you need a standalone center of excellence, dedicated category management teams or a hybrid approach? Tailor this approach to reap long-term benefits.

3) Scalability and Innovation

Innovation and agility are essential to lasting success. Implement a category review process which is easily replicable across the business, capable of annually reviewing multiple categories at once, reducing the time from decision to shelf as much as possible.

4) Vendor Portfolio

With the Private Brand market less developed in the US, it follows that the dedicated vendor base is also smaller. Mutually beneficial partnerships underpin all great Private Brand programs. Outside the box thinking, like joint ventures or exclusive partnerships, will accelerate and foster innovation.

5) GTM Strategy

Finally, you must have a go-to-market strategy which aligns all parts of the business around a unified goal: Private Brand excellence. This includes effective packaging to on time deliveries to fully executed planograms and effective marketing.

CRG has unique expertise to partner with retailers who want to accelerate their Private Brand journey

Amid slow growth and intense competition in the grocery market, retailers need innovative strategies to maintain and expand their market share. The impressive growth of private brands provides a chance to stand out, capture market share, and increase profits. In a markets where every advantage counts, a robust private brand program is not just an option but a strategic imperative for thriving in today’s grocery market.

The A&M CRG team has a unique mix of consultants and experienced operators who are hands-on to quickly assess and build private brand strategies. Our teams have led comprehensive private brand programs for national retailers, driving significant positive change. With CRG’s battle-tested methodology, we’re equipped to help retailers accelerate their private brand journey effectively and efficiently.

A&M’s CRG team is the right partner to help you accelerate your private brand business and win in the market.

By Marco Valentini , Chris Creyts, Logan Sabella, and Scott Berger