US Manufacturing Offshoring Redux:

Mexico regains lead over China for first time in 21 years

Back to All

Insights

Mexico overtakes China for the lead in US manufacturing offshoring

Manufacturing is moving to Mexico once again. However, this time, rather than heading south from the US, manufacturers are migrating to Mexico from China.

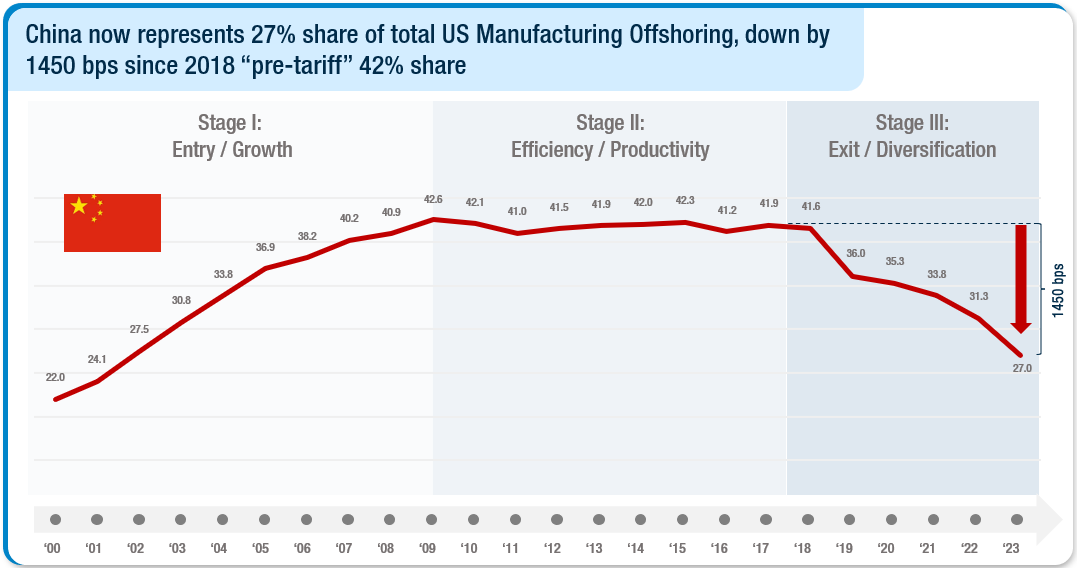

For more than two decades since joining the World Trade Organization at the end of 2001, China has outpaced Mexico as the leading destination for US manufacturing “offshoring,” the practice of relocating manufacturing from the US to low-cost countries for import back into the US.

Now, in an effort to strengthen and shorten supply chains and mitigate Section 301 import tariffs, US companies are seeking offshore manufacturing outside of China, increasingly in favor of Mexico.

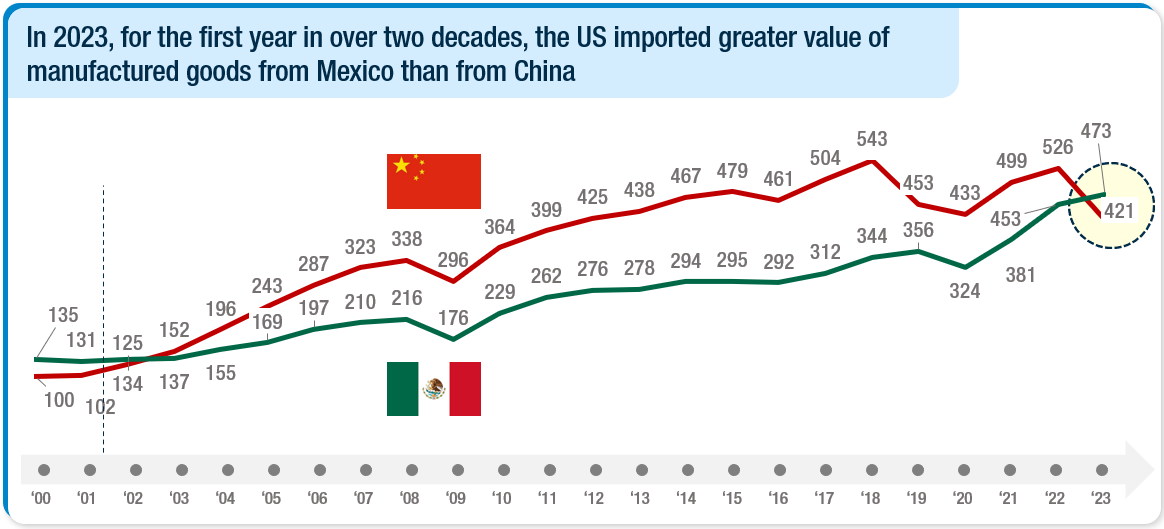

In 2023, US imports of manufactured goods from Mexico narrowly surpassed those from China, $473 billion to $421 billion respectively, an edge of $52 billion in Mexico’s favor. This figure compares to China’s $73 billion lead over Mexico in 2022 and a record ~$200 billion gap in 2018. While manufactured goods imports from Mexico into the US grew by a healthy 4%, or $20 billion, in 2023 year-over-year, China was down by a staggering 20%, or a decrease of slightly more than $100 billion. The speed and scale of this shift is staggering!

US Companies must understand these trends and adjust their supply chain strategies to meet the challenges and opportunities of this new reality.

So how has the offshoring landscape changed since 2018, the year in which Section 301 import tariffs on China first took effect?

US manufacturing offshoring continues to expand

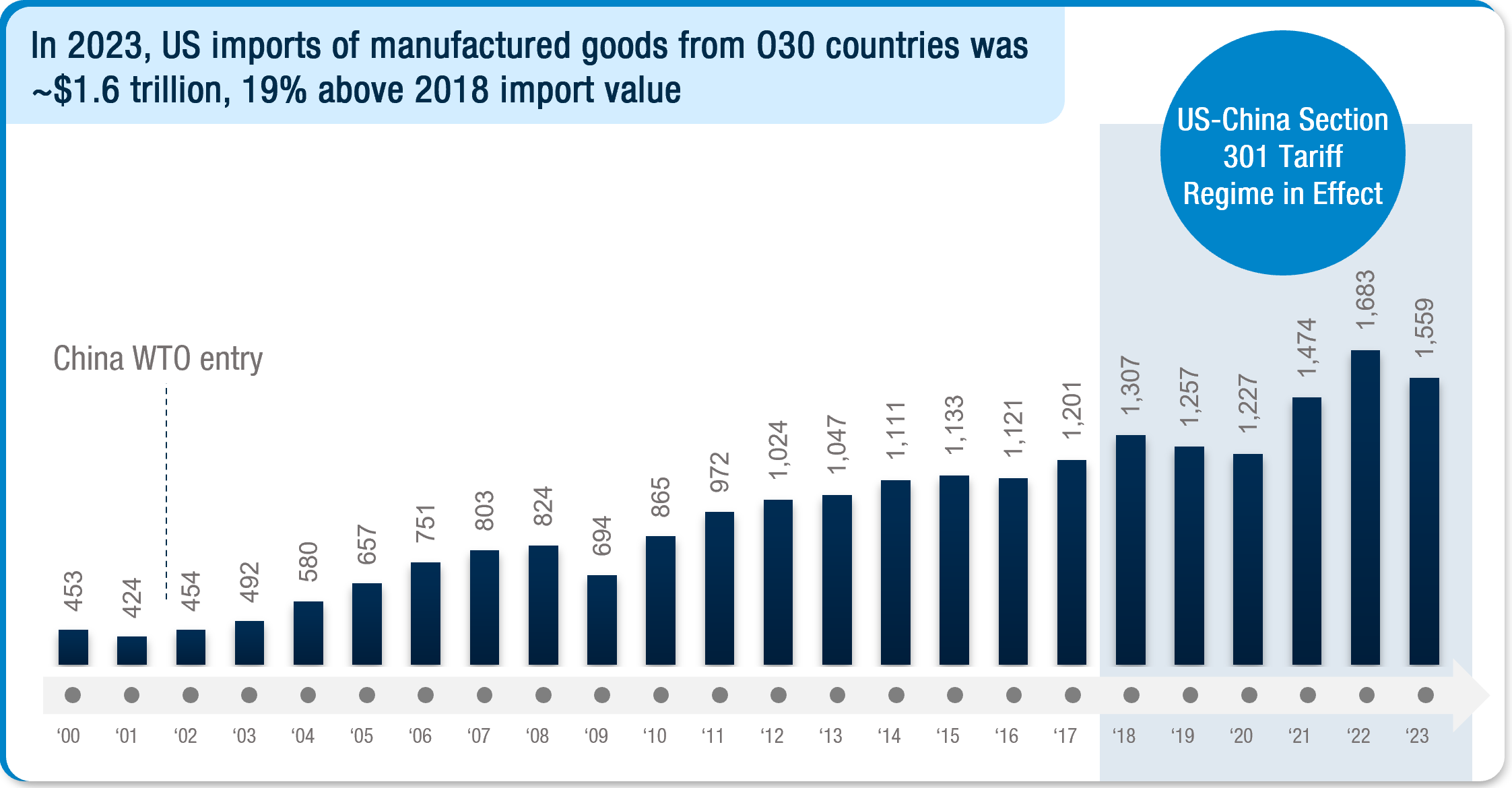

The big wave of manufacturing repatriation to the US that some predicted early in the current Section 301 tariff regime has not arrived. In fact, in the last five years, offshoring has grown by a CAGR of 4% per year, as measured by the US import value of manufactured goods coming from the largest thirty offshoring low-cost countries (“O30”).

In 2023, US imports of manufactured goods from O30 countries exceeded $1.5 trillion, down by nearly 10% from an inflation-fueled 2022 record $1.7 trillion, but still 19% higher than the $1.3 trillion in 2018.

Growth has slowed, but the long-term trend towards expansion shows no signs of stopping.

Source: USITC, US Import Customs Value from “Manufacturing Offshoring 30" (Farshoring: Bangladesh, Burma, Cambodia, China, Hong Kong, India, Indonesia, Laos, Macau, Malaysia, Pakistan, Philippines, Singapore, South Korea, Sri Lanka, Taiwan, Thailand, Vietnam; Nearshoring: Bahamas, Costa Rica, Dominican Republic, El Salvador, Guatemala, Haiti, Honduras, Jamaica, Mexico, Nicaragua, Peru, Trinidad & Tobago); A&M analysis

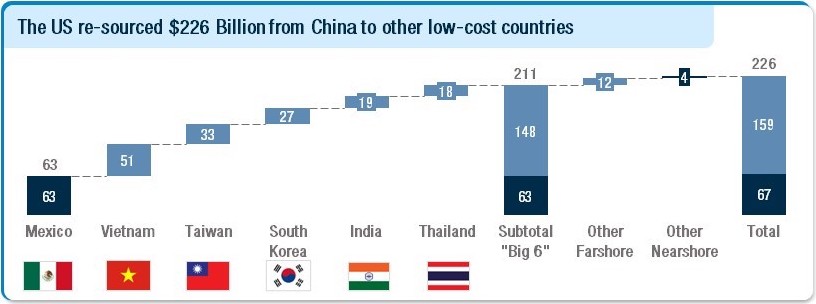

Total manufactured goods displacement from China is in excess of $226 billion annually

The magnitude of the move is extraordinary. Our model, based on changes in NAIC4-level commodity offshoring share from 2018 to 2023, estimates the total value of the re-sourcing from China to other low-cost countries to exceed $226 billion annually, even excluding manufacturing reshored to the US. Consider the mammoth effort to execute this transfer successfully!

Some of the value is doubtless driven by price rather than by quantity, given the inflationary impact of relocating this much manufacturing in such a short period of time. But it was a price that US manufacturers were willing to pay given the available alternatives.

Mexico is the biggest winner, but there are many other beneficiaries

With an estimated $63 billion annual gain in offshoring, Mexico is the largest receiving country to date. Perhaps this comes as no surprise, given Mexico’s unique size and proximity to the US market. Even before the incremental duty costs on goods imported from China, many US manufacturers were evaluating nearshoring China production to reduce lead times and transit costs. Growth of Chinese-backed investment in Mexico, on the other hand, is one key enabler boosting US imports from Mexico.

However, after Mexico, the next five biggest beneficiaries are all “farshore”: Vietnam, Taiwan, South Korea, India, and Thailand. Collectively, these five farshore transfers represent $148 billion, more than double the gains accorded to Mexico. In total, $159 billion of the $226 billion displacement has been relocated from China to other farshore low-cost countries, indicating a premium for now on speed of transition and proximity to inputs and raw materials in China.

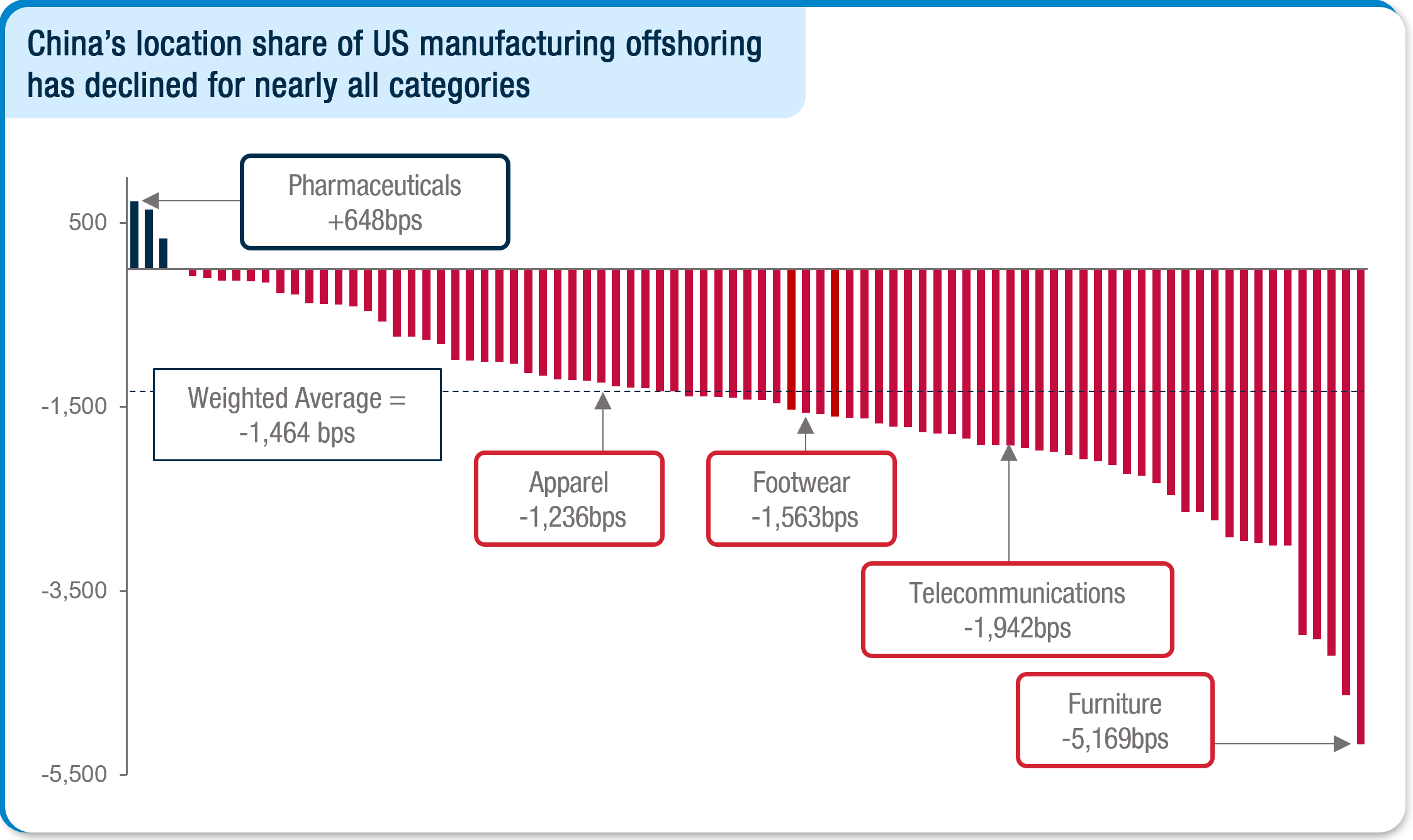

Nearly every product category has been impacted

Location diversification from China delivers significant impacts across multiple channels, with its effects felt not just in electronics, the largest category by impact value, but across a vast spectrum of consumer categories. This includes footwear and apparel, where overreliance on Chinese manufacturing had previously been a notable trend.

This strategic shift, exemplified by the pivot to nations like Mexico—bolstered by trade accords such as NAFTA/USMCA—underscores Mexico’s attractiveness in various sectors, notably in automotive, where it boasts a rich history of manufacturing prowess.

The modification of existing trade agreements among North American partners is prompting U.S. enterprises to reassess their supply chains, which were predominantly East Asia-focused, and to explore deeper engagements within Latin and South America.

This trend is substantially enhancing Mexico’s role in absorbing production capacities that were once centralized in China, indicating a thorough reconsideration of global supply chain strategies beyond electronics to encompass apparel & footwear, automotive, and more in response to global economic dynamics.

So, what do US companies need to do about it?

For US companies evaluating global low-cost manufacturing alternatives, Mexico’s resurgence past China signals important new directions in supply chain strategy:

- Long-term single-country dependence has proven untenable, even if the current US tariff regime changes at some point, Simply moving everything from China across the southern border to Vietnam, as an example, does not solve the underlying risk. Country-level diversification of manufacturing is here to stay

- For many product categories, regional diversification will be the norm– including dual hemisphere models. The “base case” is now no longer “China plus”, but rather “East and West” operating seamlessly

- Global sourcing teams – often still China-centric – do not fit the new reality. Rebalancing sourcing infrastructure outside of China is overdue for many US companies, which likely means spreading resources more thinly over a larger geography. “Wait-and-see” on this topic no longer works

- Time horizons for migrating production are shorter than ever. Consider the pace of change even in the last five years exiting China. This is not a “forever” investment decision. Experienced US companies will be able to move even faster the next time

- Mexico is the biggest (and often closest), but not the only, nearshore option. Mexico risks should be evaluated on their own right, in fair comparison to other near neighbors.

Businesses shift from a China-centric to a globally diversified sourcing infrastructure and manufacturing footprint, enhancing global supply chain resilience and cost management.

What happens next?

But do not forget China as a critical part of US companies’ offshore manufacturing footprint. We expect to see this year China to vigorously defend US offshoring share, aided by favorable policies and competitive manufacturing ecosystem. Moreover, Chinese companies will continue to expand overseas investment, bolstering global manufacturing influence.

In conclusion, while we would project Mexico to retain the lead US offshoring position this year, China will stay in close pursuit. Indeed, as trade volumes for major categories in which China still holds the lead recover, expect the CSI Index to rebound slightly after the last five years of decline.

By Brooks Levering, Lisa Collier, TZ Shen, Sanjeev Dua, Luis De Lencquesaing, Jeff Bell, and Ericka Lu