Retail’s Trojan Horse:

Tackling the Complexities of Internal Shrink

Back to All

Insights

Theft has dominated retail headlines over the past few years. The Wall Street Journal estimates shrink rose to $143bn in 2023, or 2% of net retail sales, up from 1.4% and 1.6% in 2021 and 2022, respectively. In addition to these jarring statistics, the larger issue is more difficult to measure: the impact on sales and consumer loyalty.

Retailers have responded in various ways – some closing stores, others barricading products behind glass, and many adding staff to dedicated Loss Prevention teams. However, while it is often difficult to see concrete evidence that these measures are making a difference, it is clear such programs frequently lead to lost sales and consumer frustration.

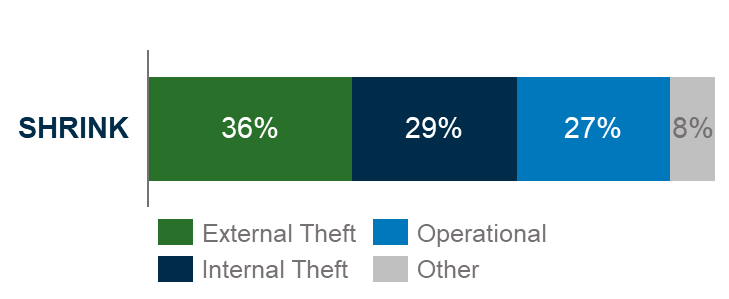

At first glance, it appears retail has an outside theft problem. Dive into the details, however, and the reality is that over 50% of shrink is driven by internal factors such as employee theft and operational inefficiencies. Furthermore, the average internal theft incident amounts to $2,000 as opposed to under $500 for external instances. In other words, while retail does have a theft problem, its bigger shrink issue lies within.

With this in mind, it is critical for teams to pin-point exactly where shrink is occurring in the business and address it with a neutral or positive impact on sales. And while it may be tempting to blame external factors rather than take a hard look in the mirror—no one ever wants to second-guess their own people or processes—confronting this “Trojan Horse of Retail” is a difficult but necessary step to improve the bottom line.

1 Lowe, Corey. “2023 Retail Security Survey,” 2023.

Inside Job: How to Identify Internal Theft Patterns in Retail

Internal theft accounts for nearly one-third of shrink, a figure that may seem surprising. However, given employees’ access to inventory and in-depth knowledge of security procedures, retailers are taking this phenomenon seriously: 57% report they are more concerned about internal theft now than they were 5 years ago.

Employee theft manifests itself in a variety of forms. These range from merchandising and cash theft to refund fraud to “sweet-hearting” — passing along free merchandise or unauthorized discounts to friends or family. Regardless of the type, retailers need to be assertive in how they mitigate and deter internal theft to not only protect their margins but also to foster a healthy working culture among field teams. Retailers should prioritize solutions by balancing the size of the potential benefit with the resources and risks associated with each strategy. A simple approach is to bucket initiatives as Now, Next or Later, where “Now” is for quick wins, “Next” is for initiatives to launch in the next 6 months, and “Later,” is for 6 months or beyond.

Solution 1: Raise Awareness and Host Trainings on Current Anti-Theft Policies and Activities

NOW (Quick Win): There’s no need to reinvent the wheel here—many companies already have robust asset protection programs but need to raise employee awareness that they exist and are being enforced. Ensure your current procedures are credible and well-known to deter inside jobs. Simple actions like signage, employee newsletters, or manager-led discussions can help, as can communicating when arrests occur. Additionally, periodic training is a relatively low-cost tactic to enhance security before investing in new technology or revamping your broader security strategy. In addition to deterring internal theft, these measures also reassure the vast majority of the workforce—who are honest employees—that bad actors are being held accountable.

Solution 2: Standardize the Process for Case Building and Working with Law Enforcement

NOW (Quick Win): When internal theft occurs, having a standard procedure in place to collect information and share it with law enforcement is crucial for addressing the incident and facilitating arrests, if appropriate. Having a templatized incident report to record the time and location of the incident, items stolen, how the theft was discovered, and subsequent actions taken will help law enforcement expedite their response. Supplementing this data with photos or surveillance footage will also enable authorities to take swift action. To make sure you are complete in your case building process, we recommend partnering with local authorities to design that standard set of information and evidence and establish an effective process when incidents do occur.

Solution 3: Launch Internal Security “Tip” Hotlines to Report Instances of Internal Theft

NEXT (6-month initiative): Store associates are the eyes-and-ears of daily operations. Empowering these employees to protect the integrity of the business not only reduces theft and protects sales, but also builds a culture committed to theft mitigation and deterrence in the DNA of the store organization. There are two keys to successfully implementing a hotline. First, it must be completely, truly anonymous. At no point should the “whistleblower” be asked anything that could identify them. Second, it must be a frictionless process to report an incident. A 24/7 phone number where employees can either leave a message or opt for a conversation is the simplest solution. On a recent engagement with a large discount retailer, we saw a 20%+ reduction in shrink in high-theft stores that began reporting incidents for the Loss Prevention team to investigate and address.

Solution 4: Invest in Surveillance Technology

LATER (6 month+ initiative): Standard monitoring most often takes the form of security cameras, which act as both a deterrent and a useful tool for case filing when incidents occur. Those willing to invest additional capital for more sophisticated protection should consider more advanced technologies – of which there is no shortage to choose from. For example, AI-equipped cameras can recognize suspicious behaviors in aisles and behind the counter, while fraud detection software like Kount and DataDome can be integrated into POS systems. These solutions do come with a price, so it’s important to perform the proper diligence to understand the ROI before investing.

Operations Optimization: How to Identify Operational Shrink Patterns in Retail

Operational Shrink—loss caused by process, control failures and errors—is estimated to account for approximately 27% of total retail shrink. As is the case with employee-driven theft, operational shrink comes down to internal process breakdowns that lead to the loss of inventory.

The most common forms of operational shrink are damaged/outdated products and paper shrink, otherwise known as phantom inventory (i.e., discrepancies between physical inventory and book inventory). Each of these can be mitigated with robust process guidelines for store and warehouse staff to ensure the proper handling and recording of physical products.

Solution 1: Standardize a Comprehensive In-Store Receiving Process

NOW (Quick Win): In general, it is best to keep your physical product flow as simple as possible, and product receipt at stores is a critical step in that flow. Having properly packaged and clearly labeled products will help store teams identify delicate items and take extra care while handling them. Keeping back rooms organized ensures product is easily found and counted. Additionally, vendors often make mistakes, especially on larger order quantities, so employing quality control on suppliers’ shipments can help identify and mitigate shrink even before the product is received and processed. This most commonly takes the form of “3-way matching” – ensuring that purchase order, order receipt, and invoice all tell the same story. Periodic, random audits of suppliers to ensure they are meeting quality standards will ensure that vendors are living up to their SLA’s and delivering product in good form to the final node in the supply chain.

Solution 2: Ensure Operational Hygiene at Checkout

NOW (Quick Win): Once products are received in store, they’re still not yet across the ‘finish line’ and can still fall victim to shrink. Staying focused on the top drivers of operational shrink after receipt is important here, and checkout is an all-too-common problem area, with mis-scans at the POS driving inventory discrepancies. This can include items not being scanned at all, employees inputting the incorrect quantity, assigning a sale to a similar item, or customers making mistakes at self-checkout. Having proper training for employees to ensure they are set up for success can minimize these issues, as can regular quality checks by store managers on products that are more prone to mis-scans.

Solution 3: Evaluate and Improve Current In-Store Inventory Tracking Methods

NEXT (6-month initiative): Often times, companies have been using the same inventory tracking methods for so long that they haven’t taken a step back to ask, “How accurate is our tracking really?” It is important to have a structured approach to inventory checks through cycle counting, so operators should first evaluate their current processes with a keen eye for improvement. For example, ABC categorization will provide the most return on labor by counting high-value “A” items most frequently. Once the fundamental processes are nailed down, inventory tracking can be further improved by automating manual activities through the use of technology like RFID scanners and barcodes for real-time tracking. Best-in-class companies even fortify their inventory management with “exception” reporting mechanisms, algorithms deployed to detect inventory spikes or unexpected shortages that trigger reviews in-stores.

Solution 4: Ensure Accuracy of Key Attributes in Your Product Master Data

NEXT (6-month initiative): Master data may not be the most thrilling topic to discuss with a team of executives, but having accurate, timely data can make all the difference. Specifically, ensure the units and quantities of items are correct (e.g., items-per-case, unit of measure) to verify you have as many items on the shelves as you think. Though it may seem simple, this practice will ultimately protect sales and limit overstocks. Furthermore, auditing a sample of items that have a higher potential for data discrepancies, along with a deep-dive into current master data management processes, can reveal blind spots you never knew existed.

The road to confronting shrink starts by looking in the mirror.

Tackling shrink has never been easy.

It’s even more complicated, and sensitive, when coming to terms with the common reality that most shrink stems from the inside. Thus, it is critical to approach this complex issue from all angles — both to limit shrink itself, and to unlock sales through improved availability.

At A&M CRG, we are encouraging retail operators to take a step back and look within to understand where shrink is concentrated in the business. We have seen first-hand that taking this approach to confronting the “Trojan Horse of Retail” can drive real impact. While it can be difficult to shift focus inwards, the good news is that shrink driven by internal factors is an area where organizations can make an impact–fast.

At A&M Consumer and Retail Group, we have the experience and resources to support you during these turbulent times. We are passionate about helping companies achieve their maximum potential and landing on the right side of disruption. We look forward to connecting.

By Dave Ritter, John Clear, Jeremy Levine, Conor Gaffney, and Sammy Potter