In-Store Technology: Customer-Facing Retail Tech Report — Grocery Edition

Back to All InsightsWe have all been part of the digital revolution in some way or another over the last several years. Whether it’s the transformation of mobile apps, introduction of self-checkout lines, or most recently the influx of smart technology and AI, digitalization has and continues to transform the value chain in every industry—and retail is no exception.

As in-store shopping surges back to relevance three years after the pandemic, retailers are renewing focus on the in-store experience to address fundamental pain points and enhance the shopping experience, all while finding new and innovative ways to manage cost and optimize operations.

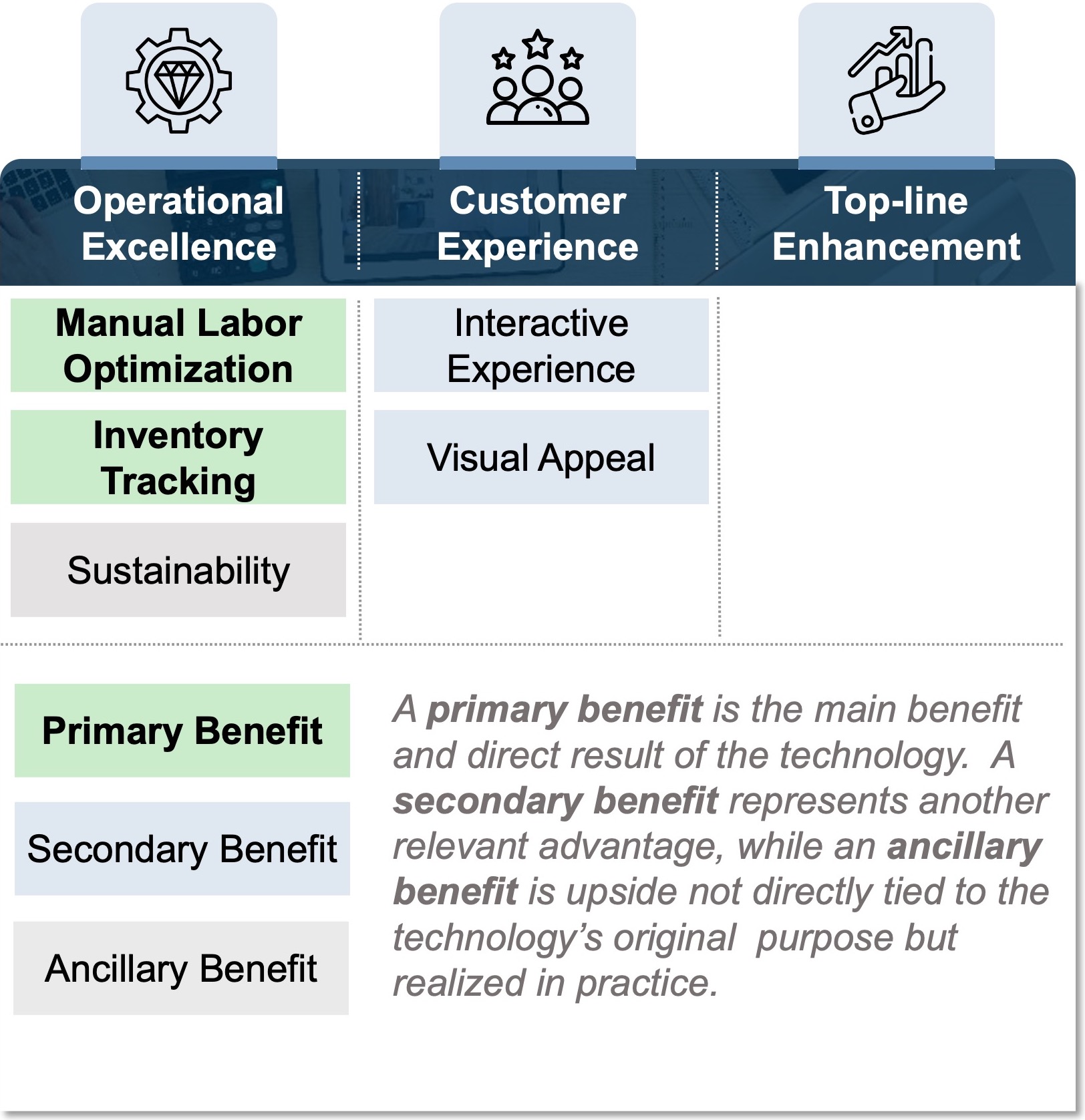

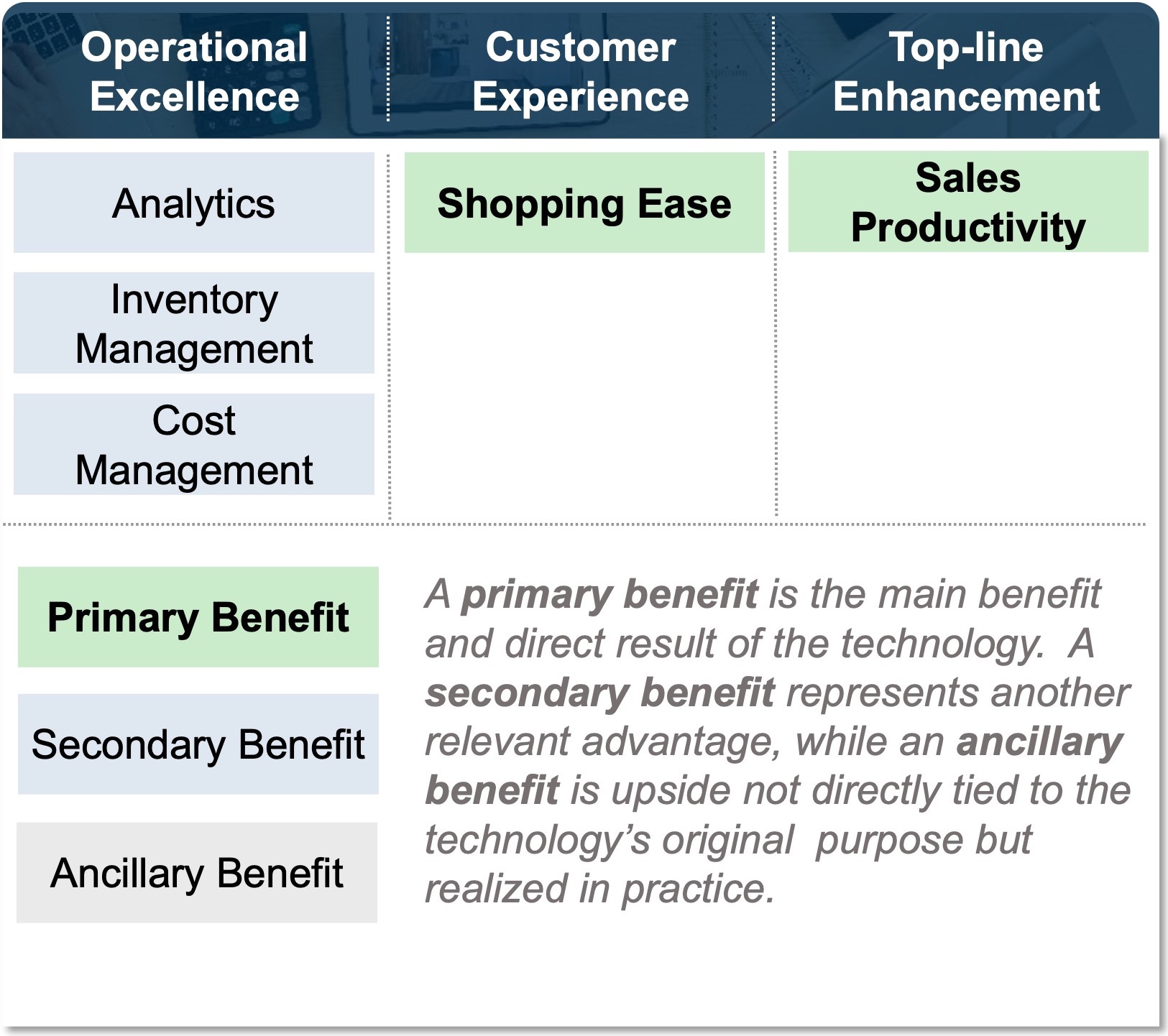

So why do retailers invest in any particular tech? We at CRG have created a simple three-point framework to synthesize why retailers make in-store investments:

This framework highlights the three strategic areas a technology can address and create meaningful ROI. Through Operational Excellence, a retailer can create efficiencies and enhance margin. Improving Customer Experience helps differentiate as a retailer. And by way of Top-line Enhancement, a retailer can, of course, sell more goods and services. As these principles do not change, we will use this framework in future editions of this report.

In the first segment of this ongoing series, our retail and tech experts dive deep into three distinct technologies—Electronic Shelf Labels, Dynamic Digital Merchandising Screens, and Smart Carts—to understand how they perform against this framework and add value for retail operators.

1) Electronic Shelf Labels

Depending on its size, a full-format grocery store can have anywhere between 15,000-60,000 SKUs. As a result, retail workers typically change thousands of labels each week to keep prices and product details up-to-date.

Electronic Shelf Labels (ESLs) replace traditional paper labels that need to be regularly swapped out. As labor costs continue to remain high, more and more retailers are focused on optimizing their workforce, and ESLs are emerging as a tool to boost cost efficiencies. Labor shortages of today are real and affecting grocers’ store operations. ESLs will save tremendous labor hours in manual label changes.

The global ESL market is projected to reach $3.5 billion by 2031 at a 15.5% CAGR, and it’s easy to see why. Although widely used in Europe, the technology has recently piqued interest in the U.S. market with the partnership between Walmart and SES-Imagotag, who together will deploy 60 million tags across 500 stores in a Phase 1 rollout. We expect to see more retailers adopt this technology since it addresses several pain points for retailers and consumers alike.

Benefits We See Today

Future Potential

In addition to benefits that exist today, there is potential for this technology to be combined with cameras / computer vision to allow retailers and brands to learn shopper behavior (e.g., dwell time) and ultimately better serve their customers. There is also potential for dynamic pricing which will enable timely and consistent price and promotional changes across store fleets, enhancing sale productivity and reaction to market changes.

Though there are several benefits to ESLs, there are also activities that need to be performed regularly in order to maintain a sophisticated network of such devices, including maintaining connected inventory tracking systems, keeping pricing databases updated, monitoring connectivity, and troubleshooting technical issues.

As such, the feasibility of this tech can vary greatly depending on the size of the retailer and specific requirements (e.g., number of devices and frequency of updates). That said, we believe more and more retailers will turn to it because of the inherently high ROI potential despite the additional implementation and support costs.

2) Dynamic Digital Merchandising Screens

Dynamic Digital Merchandising screens are typically LCD or LED displays that that can be mounted at various points of the store and mainly found on the front of coolers or refrigerators today. On a cooler, retailers most often choose to display a digital plan-o-gram and use a connected media player to manage additional content displayed on the screen, including advertisements, promotional messages, and product information, allowing retailers to alter the content displayed at will.

Digital screens have become increasingly popular in retail environments to engage with customers and promote products, with the primary goal of top-line growth and shopper convenience. Whereas retail media networks are primarily leveraged online today, digital screens can bring those unique benefits in-store and serve as a marketing vehicle for CPG partnerships.

After a 3-year pilot, Kroger recently announced it will implement cooler screens in 500 stores, making it the technology’s largest adoption to-date. Clearly, Kroger saw the benefit and concluded the investment to be worthwhile. And it’s not just retailers that are beginning to see the advantages of this technology. Arguably, brands have been reaping much of the benefits – per the Cooler Screens website, “Vita Coco,” a popular coconut water brand, achieved a 16% sales lift over a 20-day marketing campaign on these screens, delivering 14 million impressions over the same period.

Benefits We See Today

Future Potential

While digital merchandising screens today display ads and promos to the general population, this tech has the potential to create highly personalized marketing content. Mimicking a more online experience, digital screens can become a conduit to share personalized ads and promos at-shelf once retail tech is able to identify individual customer profiles walking around the store, and couples that information with its retail media network’s advanced analytical and personalization engine.

As with any technology, there are a host of new challenges that come with the adoption of dynamic digital merchandising screens.

Consumers have expressed a level of concern over data privacy due to the sensors and cameras built into the systems. Because digital cooler screens are connected to a wireless network, they can be vulnerable to cyber attacks. Retailers need to make sure their network is secure and take measures to protect against potential data breaches.

There are additional operational factors to consider with the use of these digital screens. They may break down, the system used to monitor inventory may fault, and the ads may freeze on a static graphic. While these issues may not happen frequently, they are important to consider as retailers evaluate the use of this technology in their stores.

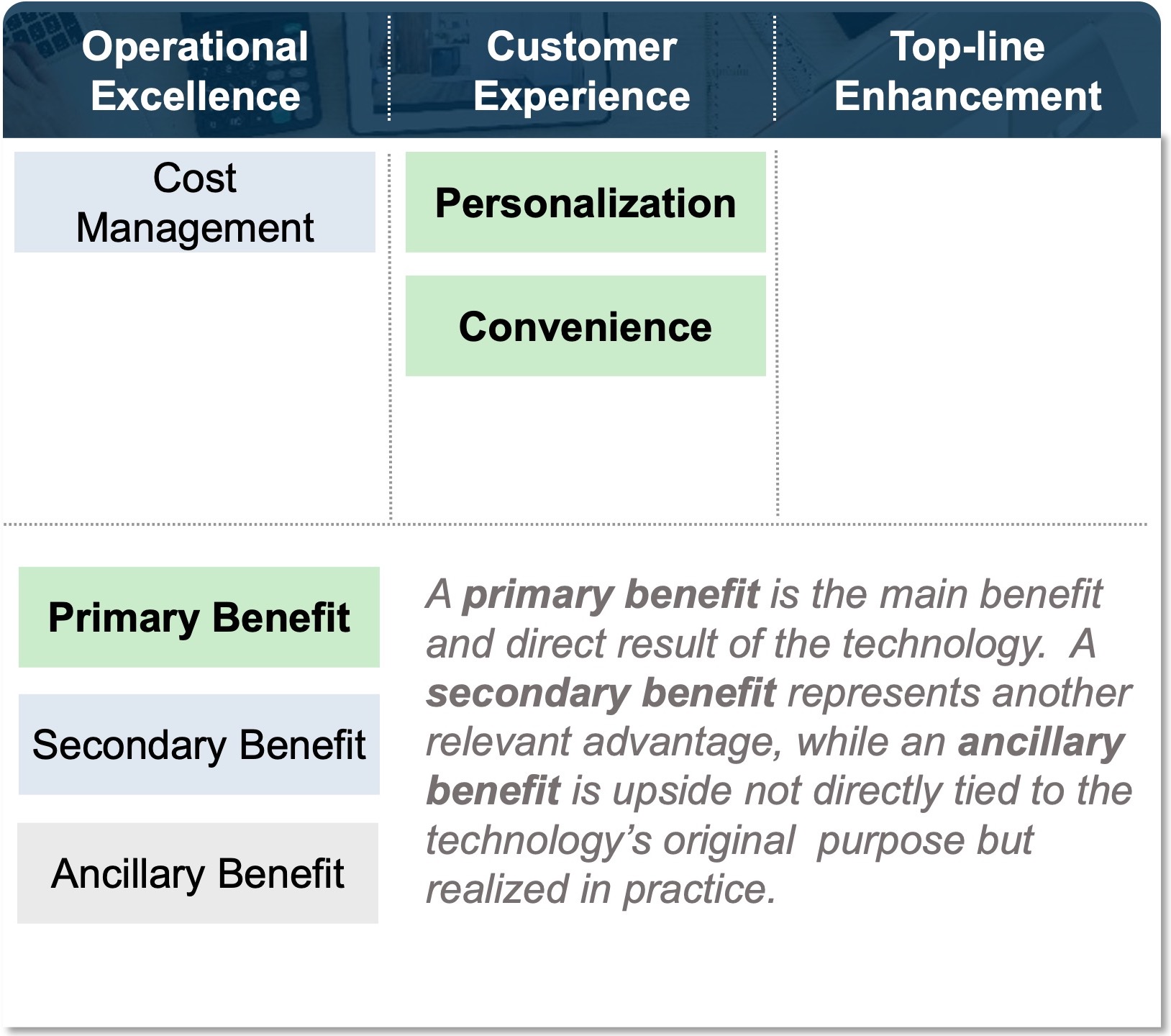

3) Smart Carts

A leading alternative to other cashier-less technologies, such as complete Just Walk Out (JWO) technology, smart carts are a type of shopping cart equipped with technology such as computer vision, sensors, and AI to provide a more convenient, if not more personalized, shopping experience.

This technology offers two distinct advantages. First, smart carts carry a convenience factor analogous to JWO and, in most newer versions, do not even require customers to scan individual items. Additionally, when paired with a retailer member/loyalty program, once a customer signs into the cart, the retailer can provide personalization in its many forms. Thus, its ROI is in the real-time, personalized customer communications with the customer.

“For now, it appears the grocery industry is set to become an early adopter of this technology in the U.S., which makes sense given it is the widest shopping cart application.”

For now, it appears the grocery industry is set to become an early adopter of this technology in the U.S., which makes sense given it is the widest shopping cart application.

Furthermore, various available features range from tallying items added-to-cart to personal grocery list integration to item locators within the store to pulling relevant product information. The feature add-ons continue to expand rapidly across smart cart manufacturers as the technology and adoption accelerate.

Benefits We See Today

Future Potential

Like dynamic digital merchandising screens, by leveraging location sensing tech, advanced analytics and CPG partnerships, this tech can help step-change the in-store customer experience, the use of in-store RMNs and personalization to reinvent how consumers shop.

Select examples of retailers introducing their versions of this tech:

- Kroger: KroGo carts, a collaboration between Kroger and tech firm Caper, are enhanced shopping carts that feature built-in food scales and cameras for quick shopping and checkouts.

- Wegmans: Shopic, one of many tech firms in the smart cart space, is collaborating with Wegman’s to test an AI-powered clip-on unit that can attach to an ordinary shopping cart and deploy computer vision to identify products and display pricing.

- Albertsons: Albertsons has partnered with Veeve to pilot smart carts with Scan, Pay, and Go technology that combines bar code scanning, computer vision, and built-in food scales to allow customers flexibility and time savings.

- Amazon: Available at select Amazon Fresh Supermarkets, and now select Whole Foods, the Dash Cart helps customers bypass the checkout lines using sensors and computer vision with the added benefit of being in the Amazon ecosystem (i.e., billing is automatic on the Cloud to an individual’s Amazon account, and purchases are recorded for future reference).

- Schnucks: Schnucks recently announced it will expand its partnership with Instacart by introducing Caper Carts, Instacart’s smart carts, into some stores this fall. The carts will use AI to allow customers to bag as they shop and checkout from anywhere in the store.

In addition to the upfront costs, concerns such as technical issues, user errors, charging capacity, theft/shrink, etc., are all challenges that come with the adoption of this technology and beg the question whether this tech is worth investing in long-term or is just a novel idea.

What are we keeping eyes on?

Download ReportIt’s an exciting time in retail. We are seeing numerous innovations in this space, and in-store tech is evolving at a rapid pace. In addition to those technologies detailed in this article, we have been keeping our eyes on pilot announcements for customer-facing retail technologies such as Freeosks, AI-powered salad bars and other fresh categories, and a multitude of computer vision use cases.

Investing in technology that can create Operational Efficiency, Improve Customer Experience and grow Top-Line is key for retailers to stay ahead in a super competitive space. We only expect technology investments to gain momentum going forward and will continue to keep our eyes on further innovation efforts.

Stay tuned for the next edition in this series as we continue our discussion of in-store tech innovations!

By Chad Lusk, David Schneidman, Rohan Bhirani & Conor Gaffney