Experiential Retail: How a Return to In-Person Shopping is Inspiring a New Retail Model

Back to All InsightsIn-person shopping has made a comeback.

As the economy continues to recover from the pandemic, consumers are enjoying in-person shopping once more, with 71% indicating they now shop in physical stores as often or even more often than they did during the pandemic1.

As these trends proliferate, many brands are turning to social media and enhanced marketing campaigns to regain consumer loyalty. However, another strategy has caught the attention of some retail executives who are looking to revamp how the in-store experience fits within the customer journey.

The Emergence of Experiential Retail

The pandemic created fundamental changes to consumer loyalty via limited product availability, inflation, and restrictions on in-person shopping that disrupted physical connection with brands. As many aspects of life return to pre-pandemic ways, brands are realizing just how important an in-person experience is to gain back long-term loyalty with consumers.

In fact, a Mood Media survey indicated that the #1 factor most likely to drive repeat visits is a pleasant store experience, followed by a good layout, uncluttered environment, and fast checkout—all key aspects of the experiential model2.

And while 75% of consumers may initially learn about a product through a digital channel, 65% of consumers opt to be in-store when actively considering a purchase3.

But just because a consumer is drawn into a store for the experience doesn’t guarantee they will buy anything. With that in mind, we explored how experiential stores are attempting to go beyond offering a pleasant store format to bridge the gap between experience and possession.

We studied a handful of stores across a variety of formats—a household-name department store, an apparel brand’s in-house flagship, and an at-home technology brand’s sleekly designed product gallery. While the long-term benefits of experiential investments remain to be seen, we found four key themes that suggest the model can, in fact, drive benefits for retailers, brands, and consumers alike.

1) Consumer Education of a Differentiated Value Proposition

Dyson leverages the experiential model to educate consumers on the meticulous work that has gone into crafting their products

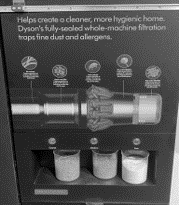

A recent study cited by Consumer Affairs revealed 3 in 5 consumers would rather pay more for something that’s better in value than opt for a cheaper alternative4. Perhaps the greatest advantage of the experiential model is that it enables customers to attain a deeper understanding of a company’s products and their value proposition. Household appliance company Dyson takes this sentiment to heart with the design of its New York experiential store.

When we think of Dyson, we think of vacuums and hair dryers, not retail stores. So, why would Dyson decide to showcase products in an ultra-sleek store layout on Fifth Avenue? Because when your motto is “Only a Dyson Works Like a Dyson,” demonstrating product performance is important. It is critical that the store speaks to and educates the customer about the company’s unmatched design and engineering.

The store achieves this by giving customers an inside look into its products: Disassembled components hang from the walls alongside detailed descriptions; highly trained employees (“Dyson Experts”) are knowledgeable about product design and functionality and can help customize the perfect vacuum; and designated demo areas provide customers an opportunity to use the product before making a purchase decision.

When your motto is “Only a Dyson Works Like a Dyson,” demonstrating product performance is important. It is critical that the store speaks to and educates the customer about the company’s unmatched design and engineering.

Given that having friendly and knowledgeable staff and offering items to see, touch and smell5 are among the top factors consumers cite for a pleasant store atmosphere, educational exhibits like Dyson’s make a lot of sense.

Exhibiting its company ethos of efficiency through creative engineering in an interactive format allows Dyson to connect with its customers in a way that traditional marketing vehicles like print or digital advertising cannot. And in a world where consumers have seemingly endless options, designing a store format that speaks to your unique value proposition may help bridge that complex gap between experience and commerce.

2) Unique Experiences that Bridge Consumers

to Purchases

A study found that engaging digital content and personalized experiences have the highest impact on consumers’ purchasing decisions – making more than 25% want to buy something in a store6.

In this evolving world of “Phy-gital Retail,” online and offline are no longer separate journeys. With their growing acceptance of the online world, consumers now expect digital capabilities to make their way into stores—60% of global shoppers have indicated that digital self-service technology is an important factor in choosing to visit a store7, putting more pressure on brands to adapt their tried-and-tested store operating models to this new reality. Indeed, integrating new technologies into stores that create excitement and convenience can serve to boost foot traffic and potentially a company’s top line.

Puma’s next generation in-store technology is a focal point of their experiential model

Puma has taken a step in this direction by including in its store an intelligent mirror designed by NOBAL. Dubbed “Your Discovery Wall,” the technology provides a plethora of product information to interested buyers. The mirror also allows users the opportunity to “Complete the Look” by providing recommendations, “Shop Similar” items, and take and email pictures of themselves.

Puma has taken a step in this direction by including in its store an intelligent mirror designed by NOBAL. Dubbed “Your Discovery Wall,” the technology provides a plethora of product information to interested buyers. The mirror also allows users the opportunity to “Complete the Look” by providing recommendations, “Shop Similar” items, and take and email pictures of themselves.

Google reports that 56% of consumers use their smartphones when shopping in-store8. People post about their experiences, which in turn inspires their followers to seek out the same. In an era where nearly 60% of the globe (~5B people!) is on social media9, designing stores for social engagement is an excellent way for retailers to extend their reach beyond the four-wall layout.

It’s no secret that technology is a key lever in improving the consumer experience—retailers of all formats are investing in these features because they know that’s what today’s consumers expect. By integrating these capabilities into the experiential model, retailers and brands can better connect with their customers and build engagement that can generate sales for years to come.

3) Real Personalization for Niche Demand Spaces

Nordstrom, Puma & Dyson all provide personalized activities to create better connections with their customers

A recent study by Epsilon found that 80% of consumers are more likely to do business with a company if it offers them personalized experiences10. Companies have everything to gain by giving consumers what they want. That’s why all three of these businesses have integrated personalization into their experiential models.

All of these stores leverage personalization to leave their customers feeling excited about the experience, which, they bet, will drive incremental sales—and there’s evidence that it can. In fact, Erik Nordstrom said that when customers interact with unique Nordstrom services like personal styling and tailoring, they can spend up to five times more than they would have without such offerings11.

4) Brand Storytelling & Consumer Immersion

Nordstrom’s New York flagship leverages local imagery to create more personal connections with their customers

Nordstrom opened its 320,000 square foot flagship location near Central Park in 2019 at a whopping cost of over $500M. Half a billion spent on one store begs the question – what does Nordstrom expect to gain from this investment?

To start, there’s the obvious benefit of owning a luxurious store in the center of New York City: Opening weekend alone saw 85,000 visits12, and it’s safe to say the prime real estate continues to bring in thousands of visitors on the weekly. The department store also reported a significant “halo effect” with revenue increasing online and in local stores following the grand opening13.

Perhaps what is harder to quantify is the benefit to the consumer experience. The store itself carries a far more local feel than a typical window-less big box. Themes from the Big Apple are evident throughout, with art depicting NYC, signage mimicking Times Square, and local clothing collections hailing from the five boroughs. Floor-to-ceiling windows provide views of neighboring buildings, while a rooftop lounge & full-service restaurant overlook 57th Street. Adjacent to the restaurant sits a small art studio, complete with display lighting and descriptions of art like what you would find at one of New York’s many museums.

In creating this NYC-inspired environment, which is still very much a shopping destination, Nordstrom is elevating its brand appeal and recognition, tapping into its strength of providing unparalleled experiences and customer service that, they believe, will provide shoppers with incentives to purchase.

What Now?

Experiential retail has a lot to offer, but should it be scaled across a network? The long-term ROI remains to be seen, but there are still some obvious learnings any retailer can apply to their own formats, regardless of scale.

The retailers we studied are leveraging flagship locations in population centers like New York and LA as a “testing ground” for the concept but haven’t rolled out these capabilities to their entire fleet. With nearly 90% of consumers indicating they trust their friends’ recommendations over any other channel14, retailers are banking that a successful experiential program in America’s hubs will inspire conversations among consumers that will ultimately drive incremental traffic and sales into these stores.

Capital requirements notwithstanding, providing a bespoke customer experience can elevate the customer relationship, increase the likelihood of a purchase, and deliver long-lasting and widespread brand equity which will pay dividends well beyond a traditional marketing cycle.

Considering that upwards of 13% of all sales are driven through word-of-mouth advertising15, a great shopping experience can have a cascading effect on a brand’s top line for years.

While it might be too early to say if experiential is a viable network-wide strategy, there are certainly elements of this practice that can and should be cascaded across a store fleet. In a sector as saturated as consumer and retail, it’s worth exploring some of the tactics that can build rapport with your consumer base and keep your business ahead of the competition.

Puma

The “Puma x You” experience features dedicated staff who design

and print shirts for customers before they leave the store

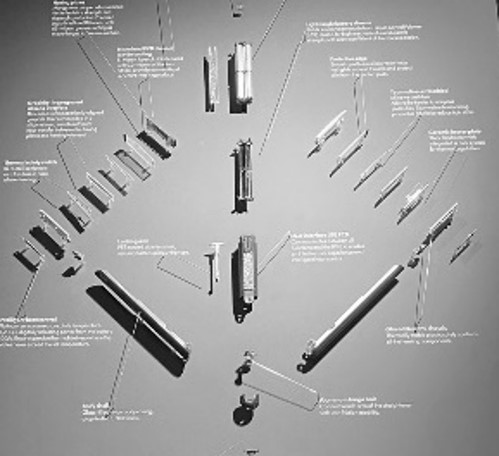

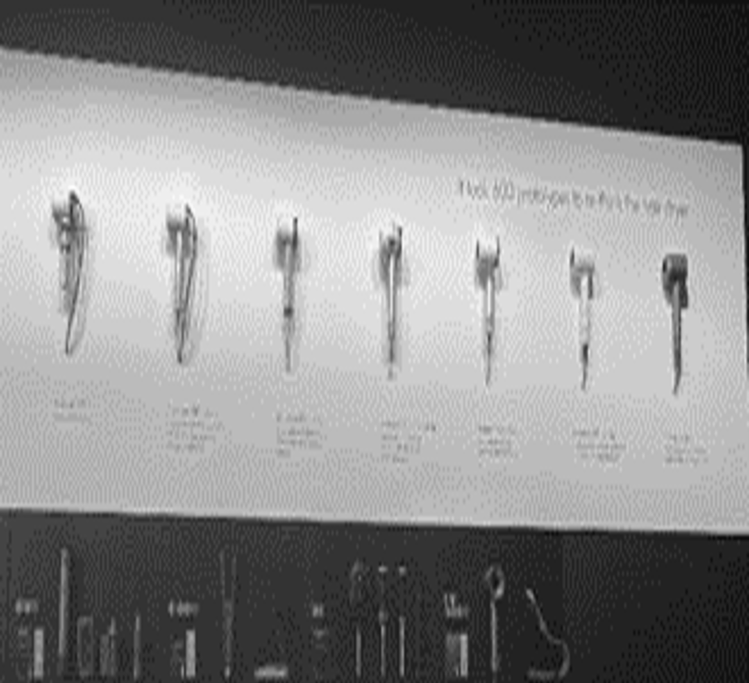

Dyson

Dyson’s store includes sleek exhibits of product components and info

on the science used to design and bring the products to market

Nordstrom

Nordstrom’s NYC Flagship features many dynamic and eccentric

displays that would be hard to find in most big-box stores

By Chad Lusk, David Schneidman, Rohan Bhirani, Conor Gaffney & Stephen Kenkel