Corporate Venture Capital for CPG Brands:

Why CVC should be on your 3-5 year growth strategy roadmap

Back to All

Insights

Venture capital-based minority investing is a diversification vehicle for CPGs

Majority investing (typically M&A) has long been the chosen path for CPGs considering inorganic growth avenues. However, minority investing through the concept of corporate venture capital (CVC) is an alternative approach that should be considered by CPGs that consider inorganic growth a pillar of their growth and diversification strategies.

Corporate venture capital is a type of investment in which corporations invest minority amounts directly into startup companies as part of their portfolio strategy. While CVC arms of large corporations are most visible, CVC is a viable strategy for CPGs of all sizes.

CVC is an increasingly popular way to access new technologies, products, markets, business models without the risk of a full acquisition or merger. Through CVCs, legacy businesses can learn new ways of winning and establish the groundwork for future acquisitions. It is a particularly attractive investment vehicle for CPG companies looking to diversify their business amidst an ever-changing consumer landscape.

The state of CPG today requires thinking differently

Large incumbent corporations have historically dominated the CPG market, benefiting from massive store-based distribution networks and strong consumer loyalty to “household name” products like Band-aid and Coca-Cola.

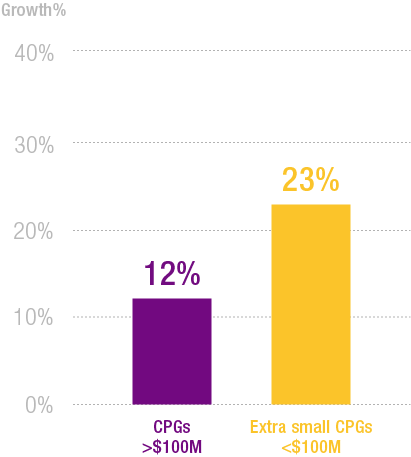

Today, however, CPG startups are fueling sector growth by developing innovative products that cater to shifting consumer preferences for sustainable and/or better-for-you health & wellness products, as examples. Although legacy players have taken an omnichannel mentality in stride, newcomers have demonstrated a strong ability to reach consumers and build loyalty through digital marketing and e-commerce channels. Since 2020, more than 4,300 CPG-focused startup brands and extra-small players (<$100 million revenue) have gained market traction, capturing 1.0 share points from large manufacturers and driving 20% of CPGs 13.4% 2020-2022 growth. If small players are paving the future of CPG, might it make sense to have them on your team?

2020-2022 Omnichannel Growth by CPG Size1

According to IRI, large manufacturers lost 1.0 share points, or $10.3 billion in sales, to smaller players who collectively drove 20% of the CPG industry’s 13.4% growth since 2020.

Many leading CPGs have already established CVCs

If complacency and/or the fear of startups eating your Sara Lee ham and Kraft American cheese lunch is keeping you up at night, CVC just might be the antidote. Several industry behemoths like Johnson & Johnson and Coca-Cola have long recognized the benefits of CVCs and distribute checks across a variety of investment focus areas. CVCs affiliated with <$10 billion CPGs, like Constellation ventures, tend to write similar check sizes but focus their investment thesis more narrowly on 1-2 specific areas.

Below, we’ve outlined a sampling of well-known CVC funds in the CPG space:

CVC provides a range of strategic and financial benefits

Corporate CVC arms benefit from the flexibility to explore high-impact opportunities and innovative partnerships outside of the parent organization, and have the freedom to decide if, and when, they would like to pursue additional investments or acquisitions. Below, we focus on 6 benefits with the highest potential impact:

Many CPGs are Leveraging CVC as a Strategic Growth Vehicle

Rakesh Narayana, GM of Reckitt Benckiser’s CVC, Access VC, acutely describes the mentality behind, and benefit of, CVC investing: “For us, it’s about helping [startups] grow faster, because at the end of the day, we would then get a better return on our investment. Are some of these companies ones that we might want to acquire in the future? Potentially, and that is also another potential benefit for them. As we get to know each other, we get to understand how they’re growing, how they’re doing and then they might become an attractive acquisition target for us in the future.”

Below, we highlight a few case studies on how CPG brands have leveraged CVC to further their strategic goals:

Anheuser Busch InBev (AB) uses CVC to expand their “Beyond Beer” diversification strategy

In 2018, AB InBev developed its Beyond Beer strategy focused on “lower and no-alcohol beverages…[including] better-for-you products, craft beers and locally inspired drinks” (AB InBev).

In 2020, AB’s CVC arm ZX Ventures invested $25M in better-for-you coffee beverage company, Super Coffee; Super Coffee signed a master distribution agreement (MDA), placing them on AB’s DSD trucks nationwide and enabling them to instantly break into national channels like Walmart.

In 2021 Super Coffee raised an additional $150M, including investment from AB, and is now valued at more than $500M. Through CVC, AB has been able to test the waters of a strategically important, but less familiar sector, benefit from high returns, and maintain a clear path to acquisition.

Tyson Ventures leverages CVC as an ESG and diversification play to provide ‘sustainable protein for a changing world’

Tyson, one of the largest animal-based protein providers in the country, has recently felt the impact of shifting consumer preferences toward plant-based meat alternatives in the vein of becoming more environmentally conscious and focusing on heart-health.

In 2019, Tyson Ventures took part in a $30M series C funding round in MycoTechnology, an innovative FoodTech startup using mushroom fermentation to enable sustainable, better-tasting, and healthier food and beverages with reduced sugar, salt and fat content.

In 2020, Tyson Ventures doubled down on MycoTechnology by participating in their $39M series D round. The investment provided critical R&D dollars, which Tyson surely believes will pay dividends as MycoTechnology’s innovations make plant-based proteins tastier, and therefore more likely to take off among mass-market consumers. Should consumers meaningfully shift away from animal protein, Tyson will be covered.

Reckitt Benckiser’s Access VC takes a purpose-led CVC approach, amplifying the voices of minority founders in underrepresented spaces

Reckitt, owner of sexual health brands like Durex and KY has continued to grow the sexual wellness category through their 2021 non-CVC-based acquisition of women’s wellness brand, Queen V. Reckitt is leveraging Access VC to further this mission.

Since Access’ inception in 2020 they have invested >$50M from pre-seed to Series C across 30 startups, including sexual wellness brand Maude and Men’s wellness brand Future Method, both of which were started by, and for, members of the LGBTQ+ community

Access VC is intentional about investing in minority founders, under-represented sub-sectors, and, in many instances, startups with B Corp status.

What to think about when considering CVC?

CPGs that have already established a CVC arm are no longer ahead of the curve – they are simply setting it. If you’re a CPG that hasn’t yet established or considered CVC as an inorganic growth channel, it should be on your 3 to 5-year strategic roadmap.

Alvarez and Marsal’s Consumer Retail Group (A&M CRG) brings the knowledge and expertise to serve as a strategic advisor and partner as you explore whether CVC is right for your business.

By Chad Lusk, David Schneidman, Kendall Loseff & Evan Skaff

Citations:

- 1. IRI Growth Leaders 2022, A&M Analysis